Don't forget, when you are already above 73, you'll have to acquire an RMD for The existing tax calendar year prior to deciding to can change to your Roth IRA—that may be, Roth conversions do not fulfill the RMD need, Whilst You may use all or part of the RMD to pay the taxes due through the conversion. On the other hand, in the event you anticipate that the heirs is going to be in the Considerably decrease tax bracket than your individual, or if you intend to depart IRA property to charity, it may not sound right to transform.

The web site isn't a suggestion to lend. The website only provides a assistance and is not an agent, representative, or broker of any lender and would not endorse or charge you for just about any personal loan or solution. The website operators are certainly not lenders, do not make loans of any sort, and do not make credit rating selections. The website collects personalized information and facts furnished by you and forwards it to associates within our lender network. You happen to be underneath no obligation to employ this Web-site or service to initiate, contact, nor apply for credit history or any financial loan product or service with any services service provider or lender. Personal loan quantities vary from $a hundred and $5,000 although not all lenders can provide as much as $five,000. Delivering your information on the web site doesn't assure you'll be approved for just a financial loan or credit score product. Cash transfer periods may possibly vary concerning lenders and will count on your specific monetary establishment. In certain conditions faxing might be essential.

In reality, the inventory marketplace strike base in March 2009, just before embarking on what would ultimately develop into a virtually decade-very long bull marketplace.

Your receipt of an electronic or other sort read more of order confirmation won't signify any acceptance of one's financial loan ask for, nor will it constitute confirmation of any offer you to fund. seventy three cash reserves the correct at any time just after receipt of one's bank loan ask for to simply accept or decrease your loan ask for for just about any explanation.

“After you’ve found ten years of almost uninterrupted gains, it’s straightforward to be complacent,” warns Houston fiscal planner Ashley Foster. “But when one thing occurs—and it'll—you might be uncovered.”

73 cash Is that this website , that's a Nevada confined liability organization. By Your use of the Site you consent into the regulations and jurisdiction on the point out of Nevada mainly because it relates immediately or indirectly towards your use of the Internet site. You concur that any authorized action brought in opposition to us shall be governed through the legal guidelines with the Point out of Nevada, without regard to conflict of law principles.

For some Americans, that’s likely to suggest buying the stock marketplace, no matter whether within a 401(k) or at an internet based brokerage. But pinpointing how much of your hard earned money To place in stocks could be tricky.

Serious communicate on closing the gender prosperity hole with Dwell functions and ideas to just take action. Educational Webinars and Events

Rewards: Annuities are elaborate, so make sure you speak with a fiscal advisor to learn more about them. Concerning gains, this Protected financial investment option supplies confirmed returns and retirement income for reassurance.

Expanding your inventory holdings can dramatically Raise the chances that your savings will previous. An Trader using a portfolio consisting solely of bonds, who invested four% of his savings yearly, might have just a 24% chance of which makes it via a 35-year retirement without having running out of money, depending on historical returns, In keeping with 1 modern review by RBC Cash Markets.

Opportunity threats: Some seniors may be at risk of fraud from folks proclaiming for being deposit brokers. It’s crucial that you investigation and overview the official on-line databases to examine the individual’s affiliation.

It is not A part of your gross cash flow and will not depend towards the bounds on deductions for charitable contributions. QCDs can have major positive aspects for certain substantial-income earners.

Uniform Life span Table III - use this When your wife or husband just isn't your sole beneficiary or your husband or wife isn't a lot more than a decade younger

Using this "Roth conversion" tactic, you will fork out cash flow tax on the amount you change, but you'll not have to bother with RMDs on that amount, mainly because RMDs aren't demanded through the life time of the original account owner in the Roth IRA.four

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Andrea Barber Then & Now!

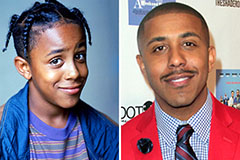

Andrea Barber Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!